A common theme this week has been the near certainty of choppy and volatile movement in between the extremes of 2010 ranges.

The past few hours have indeed seen moderate losses in the bond market--losses of a sufficient magnitude to result in scattered reprices for the worse on rate sheets--but against a more strategic and longer term backdrop some good things are actually happening. That's no guarantee they will continue to be good things by the end of the day, but for now, the market is pretty much beating us up as much as it possibly could without actually sending firm signals of further pain.

Most of what follows will be a combination of "bad news" mitigated by "yeah buts..."

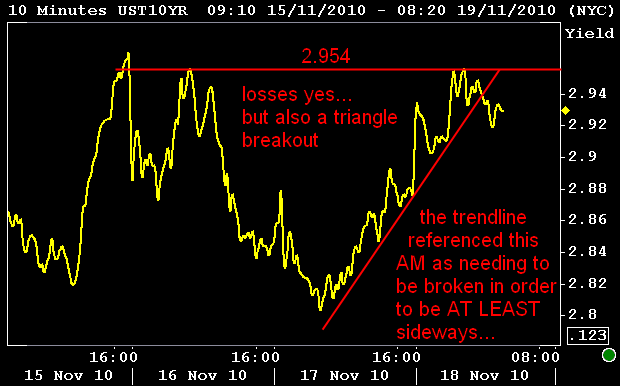

Kicking things off with the 10yr note, there's that obvious bad news of the 13 tick loss on the day that sees yields currently 4bps higher at 2.923. YEAH, BUT not only is that yield lower than the 2.963 seen on Monday, but even today's worst levels didn't violate that ceiling. That will be evident in the chart that follows, but additionally, we'll also see a breakout of the trendline I laid out in my last post as being the trend that must be broken in order to get at least a sideways vibe established in the short term. Not only do we have that breakout, but fans of cliche technical patterns will also see today and yesterday as a triangle breakout in a positive direction.

10yr chart moral of the story: yep, things got bad, but the reading on short term momentum shift is actually good for now. It's important to keep in mind, based on AQ's comments re: positional resistance, that there is a clear chance we see 10s crest at 3.00% before rally momentum is able to gain traction.

Brad Adams a Mortgage Broker specialist will get you the best and lowest mortgage rates for real estate and refinance in kelowna and all of B.C.

MBS prices have broken out of a similar 2 day triangle, and additionally benefit from the technical reality that today's lows are higher than this week's previous lows (bring me a higher low? whoah oh...?) The fact that prices break upward relatively quickly after grinding relentlessly into the narrowest spaces at the end of the triangle adds a bit of validity to a technical reading of this breakout.

I

n 10yr futures, things aren't quite as straightforwardly positive as the other two sectors, but recalling our mention of the importance of 124-11 this morning, it's at least SOMETHING to consider that prices have just recently regained that mark. Now the goal will be to maintain it by the time closing prices are marked in about an hour from now. But again...as AQ discussed earlier...the 124 put strike in 10yr futures is a target of short sellers. Touching that level before next Friday would be the best thing for bulls in the bond market at the moment...in terms of moving on with the cleansing process.

All this "ground-holding" amid a 20 pt bull-run in the S&P and one is left with the overwhelming sense that the bond market continues to do it's own thing, driven by technicals rather than supplementary market movements or data (see AQs link above). After all, without the technical significance of previous lows this week, a 20 pt run up in the S&P and a 2250% improvement in philly fed would usually be enough to see something a bit worse than a 7 tick loss in production MBS or 4bp backup in the 10yr.

Stay tuned, the mighty Ben speaks tomorrow, and will be amplified by the absence of data. Volatility remains a good bet.

If you want to get the most up to date Interest Rate information see a mortgage broker. Brad Adams in Kelowna would be happy to help.

No comments:

Post a Comment